Why are our costs of goods sold increasing when we have been so successful in securing price reductions in procurement?

This is the type of question that finance teams in automotive dread. It’s not a question of lack of skill or insight – but simply the fact that they do not have the right data to answer – and what they do have seems contradictory. As the automotive industry becomes more volatile, fast moving and unpredictable the number and range of questions like this will only increase. To stay ahead and avoid being sucked into the weeds trying to reconcile alternative views of the truth, automotive businesses need to build new frameworks for CFO Analytics that leverage existing systems to provide the granular, timely data they need to succeed.

ERP not Built for Analysis

Finance teams rely on ERP systems as the core systems of record. For most, these are the single version of the truth upon which they rely. However, they are not, nor were ever designed to be, analytics systems and simply do not contain the detailed data needed to answer today’s business questions. To perform as transactional systems that streamline crucial order to cash processes, ERPs work with aggregated data. In simplified terms, all they need is the total cost of a vehicle (or even vehicle type or class) and the unit selling price against which details of a sale can be recorded. But the devil is in the detail. With the average passenger car comprising over 6,000 parts, and more complex heavily customised vehicles like HGVs made up of 10-12,000 parts the potential for variation in the bills of material for individual vehicles is huge. Using an average, consolidated value in the ERP is efficient, but hides the real fluctuations in costs.

For example, one production line might manufacture one run of vehicle model A using parts from supplier X whose costs have been negotiated down 5%, but the following run might have to pay a premium for the same parts to overcome supply constraints. Another line might make the same vehicle using parts from a different supplier at a different cost. Parts for which deep discounts have been negotiated may sit unused in warehouses or prove to be too fault-prone to include. All this complexity is absent from the ERP. The information which explains the variance between expected and actual cost of goods sold exists only in the complete bill of materials for each vehicle. That data is likely to be scattered across multiple internal systems.

Granular, timely data needed

Heads of division across automotive businesses, and the finance teams that support them, need access granular data like this, provided in a timely and useful format in order to answer the increasingly complex business questions they encounter. Creating digital threads that connect every piece of data, on every component, to each unique vehicle creates the richness and integrity of data needed to support better financial decision-making.

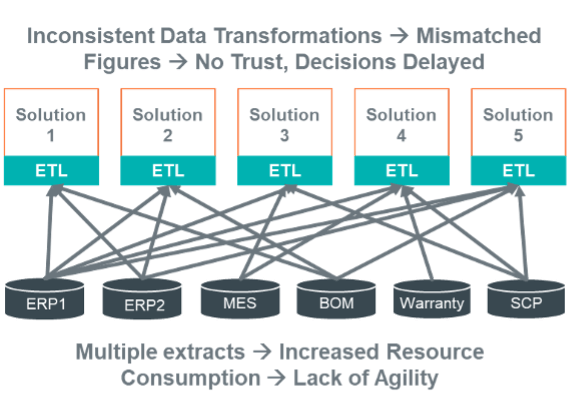

This does not require a ‘rip and replace’ approach. But, equally, building individual integrations each focused on answering specific questions is not a viable solution. Point solutions will lead to massive duplication, proliferation of parallel systems and data silos, all of which risk making it harder to drill down to the ground truth of a situation.

-(1).png?origin=fd)

A New Approach to Financial Analytics

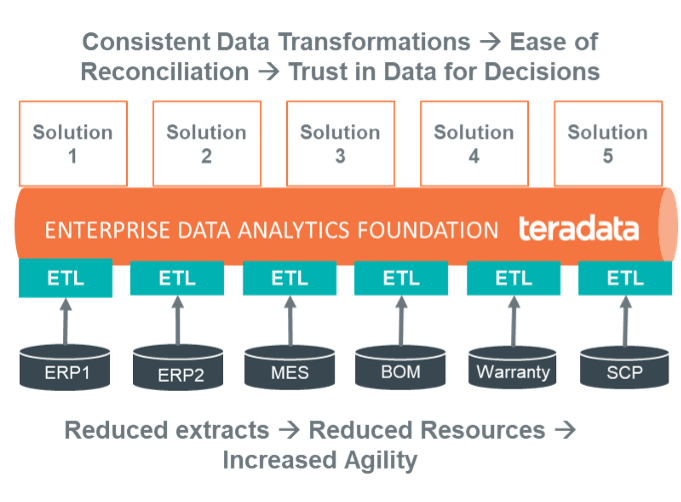

Instead, finance teams need to rethink their approach to analytics. Leveraging data from existing systems in a single enterprise data platform where consistent rules and a common data model can be applied provides the foundation for the analysis CFOs need. Starting by creating a global, standardised view of data within ERP systems will deliver swift and substantial advantages. Different formatting, naming and processing conventions, even within the same ERP instance can make it impossible to deploy meaningful analytics. Using Teradata as an integrated data platform delivers a single version of the data. Consistent business rules can be applied, uniformly, so that definitions, conversions and queries all work on the same data. Ultimately this means that critical business questions can be answered accurately and quickly. The numbers the CFO reports can be traced back to each constituent element. So, it will be possible, finally, to trace the impact of procurement’s cost saving success right through to the cost of each vehicle sold.

-(1).png?origin=fd)

ERP foundations for enterprise-wide data analytics

Creating integrated financial insights starts with providing a unified view across existing ERP and transactional systems. The Teradata approach builds on this foundation to integrate more and more systems to deliver more and more value. Quick wins can be secured with minimal investment focused on pressing current needs. As more data is added to the same global data models, more and more complex business questions can be answered. Operational reconciliations, drill downs by customer or product, multidimensional profitability analysis and predictive modelling all leverage this same foundation.

Transformation through data orchestration

Bringing the power of granular data at scale and speed to the fingertips of the CFO and the extended finance teams transforms their role. Rather than expending a significant proportion of time and resource on finding, checking and rechecking data to submit reports, they will leverage data to model, predict and test future scenarios. A single common digital fabric supports the automation of many repetitive tasks and empowers the CFO to use orchestrated, optimised data to drive revenues, profits and returns.

If you are interested in how Teradata can help you answer todays pressing financial questions, and prepare you to answer tomorrow’s questions, whatever they may be, get in touch with the Teradata Automotive Consultancy team.